Bexar County Property Tax Protest Deadline 2025. Annual protests of your san antonio property taxes are the best way to make sure your commercial properties are properly valued, and that you aren’t paying more than what’s owed. San antonio — the deadline to appeal your property value in bexar county is monday, may 15.

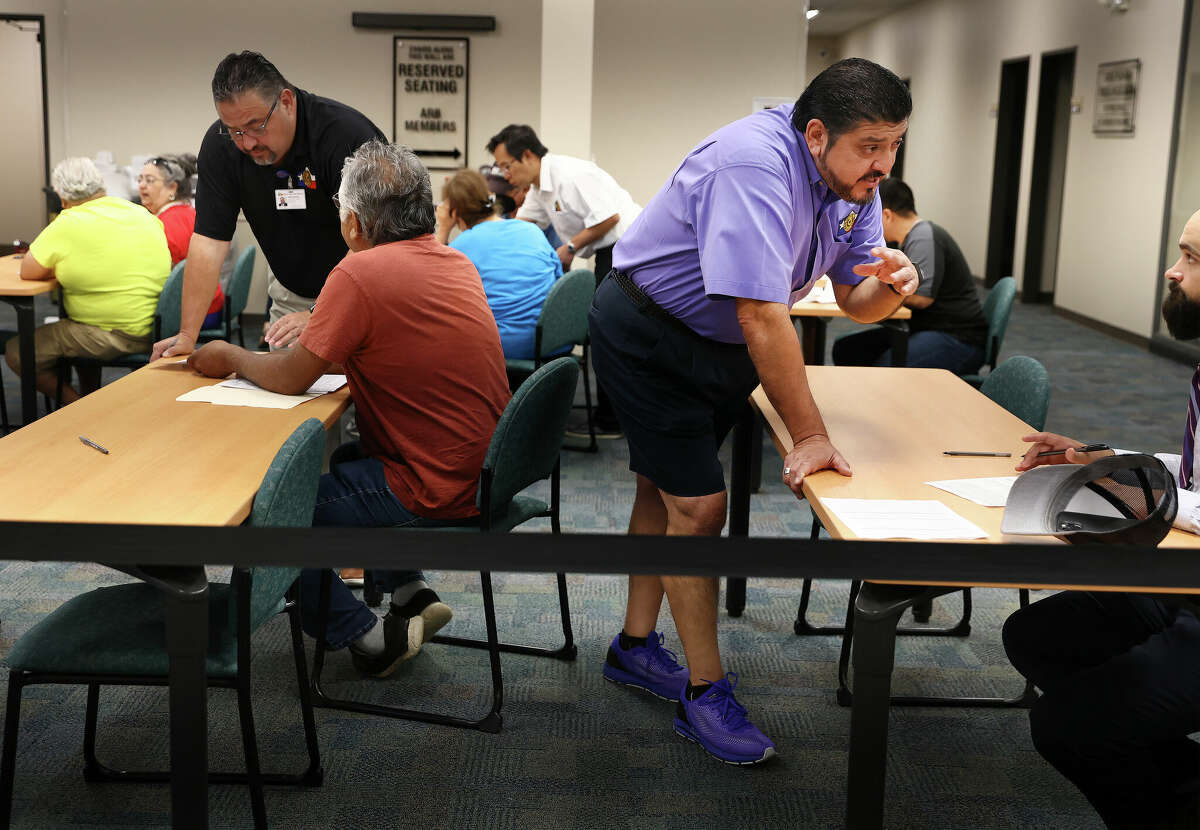

Many homeowners are seeing a big increase in their property tax appraisals. If you choose to protest the value of your property, you can initiate the protest in one of several ways:

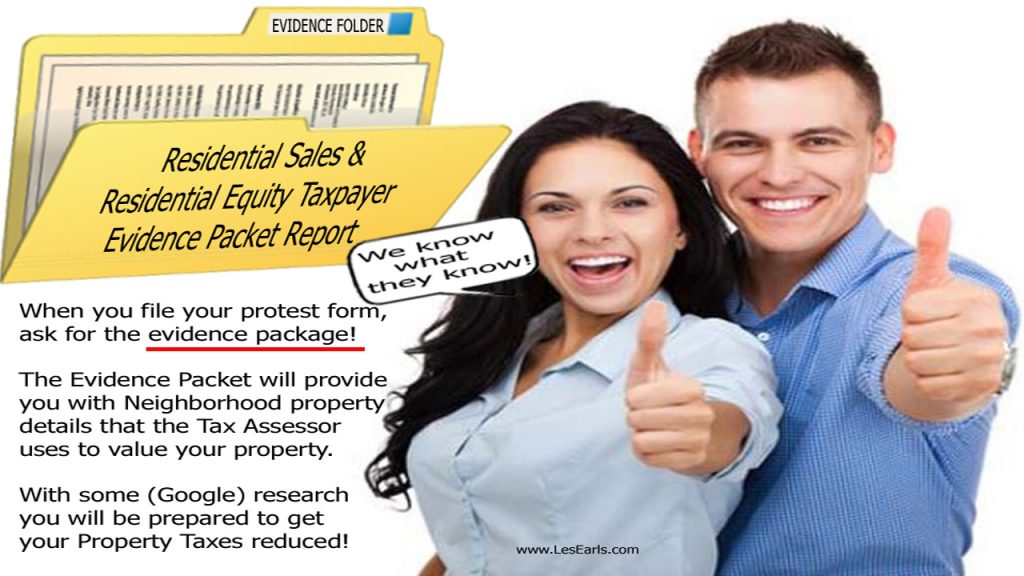

My 2019 Bexar County Property Tax Protest story Les Earls, Here’s how to protest your property appraisal. The deadline to pay taxes in bexar county is jan.

Bexar County GIS Shapefile and Property Data Texas County GIS Data, Complete list of texas comptroller property tax forms and applications click here. The deadline to protest your property tax appraisal is next week.

Will Bexar County districts, cities raise tax rates on your property, The tarrant appraisal district has. Complete list of texas comptroller property tax forms and applications click here.

Protesting Bexar County property tax appraisals made easy, The deadline to pay taxes in bexar county is jan. Monday is the last day to file a property appraisal protest with the bexar appraisal district over the most recent round of appraisals.

Deadline to appeal property taxes in Bexar County is Monday, Monday is the last day to file a property appraisal protest with the bexar appraisal district over the most recent round of appraisals. Complete list of texas comptroller property tax forms and applications click here.

Want lower property taxes? A stepbystep guide for protesting your, Annual protests of your san antonio property taxes are the best way to make sure your commercial properties are properly valued, and that you aren’t paying more than what’s owed. If you missed it, you’ll owe penalties and interest.

Protesting Bexar County property tax appraisals made easy, The deadline to protest property appraisals is may 15, or 30 days after receiving the appraisal notice. Annual protests of your san antonio property taxes are the best way to make sure your commercial properties are properly valued, and that you aren’t paying more than what’s owed.

bexar county tax office pay online Janae Ackerman, Don't make this costly mistake. San antonio — the deadline to appeal your property value in bexar county is monday, may 15.

Property Tax Assessor Bexar County PRFRTY, 8:53 pm cdt may 16, 2025. If you missed it, you’ll owe penalties and interest.

San Antonio Property Tax Protest Tips 2019 Les Earls, Today, the san antonio city council unanimously voted to double the city’s homestead exemption to 20 percent. Tarrant county property tax protest deadline 2025.